In this Issue

- Q2’25 Psychedelic Lobbying Update

- Tabernanthalog Spurs Neuroplasticity via Alternative Pathway, Davis and Delix Researchers Find

- UK Moves Toward Easing Schedule I Research Restrictions But Keeps Industry at Arm’s Length

- “Shell Games” and Whistleblowers: MassGOP Goes on Offensive Against Psychedelics Campaigners

- Aussie University Seeks Public Comments on MDMA Clinical Practice Guideline

- and more…

***

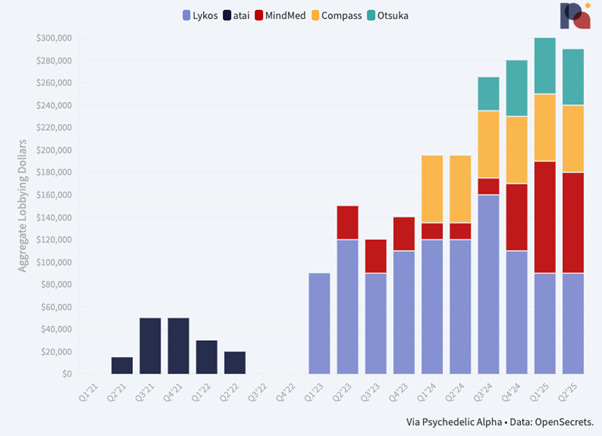

Q2’25 Psychedelic Lobbying Update

Each quarter, we provide a look at federal lobbying disclosures by psychedelic drug developers and nonprofits. That data is a lagging indicator, especially as filings are not required immediately at the end of each quarter.

Here’s a review of Q2 2025 activity…

Drug Developers: Federal Lobbying Spend Remains Stable

Psychedelic drug developers’ spend on federal lobbying in Q2’25 looked very similar to that seen in the first quarter, with all but one of the four companies reporting such activity maintaining the same level of activity.

MDMA drug developer Lykos Therapeutics holds steady with a $90k spend in Q1. However, filings show that it terminated its engagement with lobbying firm Forbes Tate Partners at the end of May. It also filed a termination report, with an effective date at the end of June, for its Chief of Government Affairs and Advocacy’s (Kacy Hutchison) lobbying activity.

MindMed spent the same as Lykos, $90k, which is down slightly from the $100k it filed in Q1, when the company led its peers in spend. Regardless, the company’s federal lobbying budget is clearly much higher than it was last year.

In its filings, the company expanded on the specific issues it’s lobbying on:

“Lack of innovation in mental health, need for more efficient communication/collaboration between FDA/DEA and need for VA to operationalize itself for when new therapies are approved by the FDA and rescheduled by the DEA.”

To that end, it’s lobbying the Senate, the House, HHS, and VA. That effort is led internally by VP Government Affairs and Patient Access, Julie Garner.

Compass Pathways again reported $60k in federal lobbying spend last quarter, the same figure it has filed since Q1’24, when it first disclosed federal lobbying outlay. But, similar to Lykos, the firm looks to have dropped its lobbying firm, in this case Holland & Knight, in favour of doing things in-house.

Indeed, filings show it terminated its engagement with the firm immediately after Q1, on April 1st. Compass’ lobbying activity is led by Eric Rasmussen, VP Government Relations and Public Policy.

As we have mentioned elsewhere, Compass’ spend on federal lobbying is likely minimal when compared to its spend on state-by-state lobbying. In the first half of 2025, for example, it spent $54k on lobbying in Massachusetts alone.

Otsuka continued a $50k engagement with The Daschle Group, but a filing suggests that no lobbying activity took place in Q2…

Sign-in or join Pα+ to continue reading this Issue of the Psychedelic Bulletin…

Join Pα+ Today

Independent data-driven reporting, analysis and commentary on the psychedelics space: from business and drug development through to policy reform and culture.

Already a member? Log In

✓ Regular Bulletins covering key topics and trends in the psychedelics space

✓ Regular articles and deep dives across psychedelic research, policy and business

✓ Interviews with insiders

✓ Monthly interactive database and commentary on psychedelic patents

✓ Quick-take analysis of major developments

✓ A Library of primers and explainers

✓ Access to our full back catalogue