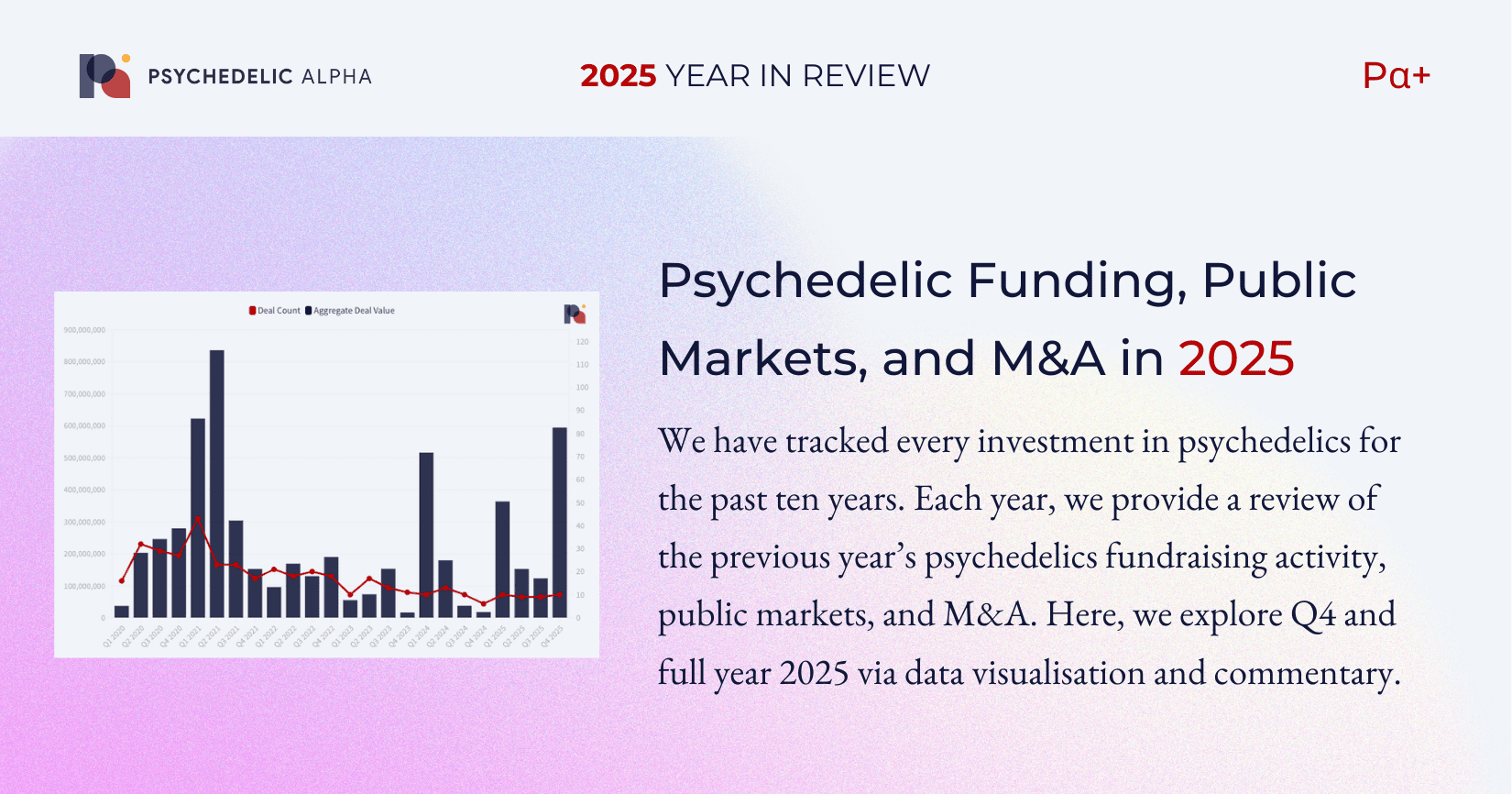

We have tracked every investment across both public and private psychedelics companies for the past ten years.

Each year, we provide a review of the previous year’s psychedelics fundraising activity, public markets, and M&A. Here’s how Q4 and full year 2025 looked…

***

Quarterly Fundraising Activity in Psychedelics

Psychedelic financing activity increased substantially in Q4 2025, with aggregate inflows reaching levels not seen since the heady days of 2021.

The end of the year was marked by three large public financings, all of which took place early in Q4:

- The first of the three major financings came from AtaiBeckley (formerly atai Life Sciences), which closed a $149.5M offering in late October.

- Then, on the final day of October, Helus Pharma (formerly Cybin) announced that it had closed a $175M direct offering.

- The largest of the three was saved until last as Definium Therapeutics (formerly MindMed) closed a $259M public offering in early November.

But that pace of financing was not maintained throughout the remainder of the quarter, with only modest rounds thereafter from much smaller companies.

Looking at the year overall, just over $1.2bn flowed into psychedelic companies, which is nearly 50% more than in 2024 and quadruple the aggregate inflows seen in 2023.

Around 90% of the dollars that flowed into the field in 2025 accrued to…

Join Pα+ Today

Independent data-driven reporting, analysis and commentary on the psychedelics space: from business and drug development through to policy reform and culture.

Already a member? Log In

✓ Regular Bulletins covering key topics and trends in the psychedelics space

✓ Regular articles and deep dives across psychedelic research, policy and business

✓ Interviews with insiders

✓ Monthly interactive database and commentary on psychedelic patents

✓ Quick-take analysis of major developments

✓ A Library of primers and explainers

✓ Access to our full back catalogue