Psychedelic Investor Pulse Survey

Summer 2022

Our Inaugural Psychedelic Investor Survey

It’s a difficult time for many psychedelics companies, with macroeconomic trends likely to make fundraising a key challenge for the foreseeable future. It is in this context that we present our inaugural Psychedelic Investor Pulse Survey (n=183).

Our Survey seeks to understand the investment activity, sentiment, and forward-looking intentions of a diverse array of investors: from individual retail investors right through to family offices, VCs and investment banks.

Below, we share high-level results from the Survey. Full results and analysis are available here.

Key Takeaways

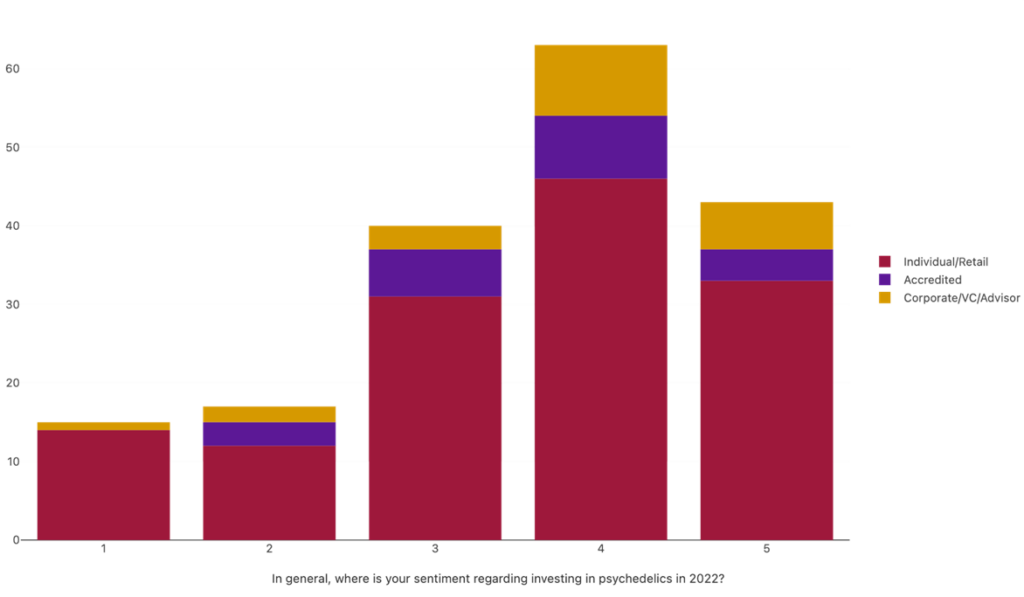

Investor Sentiment

Investor sentiment is generally positive and optimistic, and is most positive among institutional-type investors. In our full analysis we explore investors’ willingness to hold onto their psychedelic investments.

Larger Investors Intend to Stick Around

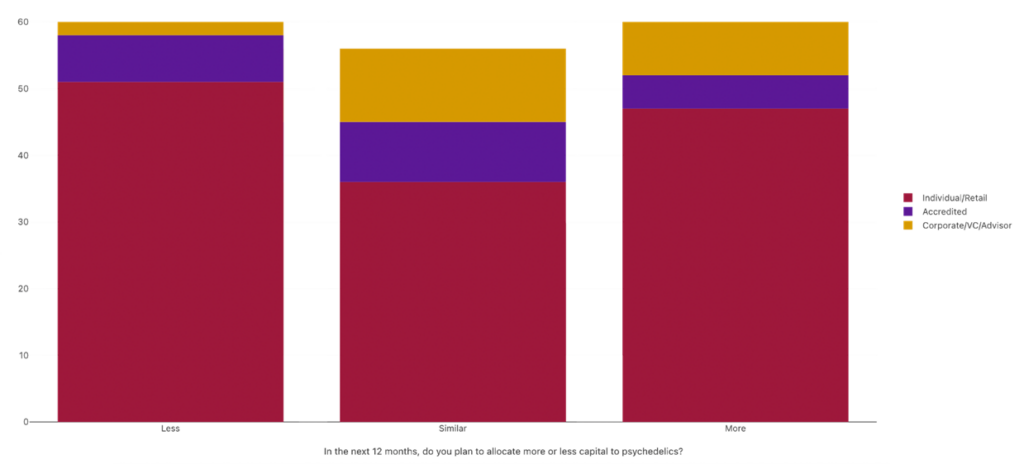

An identical number of respondents are looking to reduce their psychedelic investments in the next 12 months as those looking to increase their level of investment.

Promisingly, there is clear staying power among investors who have written larger cheques in the past 12 months (>$500,000), but those that made mid-sized allocations ($10,000 – $250,000) are expected to reduce their exposure to the space going forward.

The vast majority of investors are willing to wait over three years to see a return on their investments, with most respondents believing that the present level of interest in psychedelics is sustainable.

In the full analysis we map these intentions onto respondents’ prior 12 month allocations in order to better predict future behaviour.

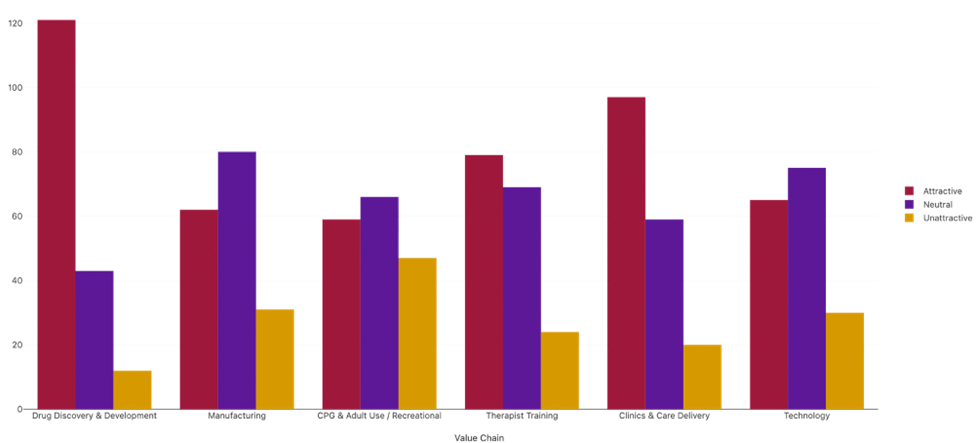

Drug Discovery & Development Remains the Most Popular Category

Drug Discovery & Development remains the most attractive value chain segment for psychedelic investors, but a focus on infrastructure is clearly emergent.

Key Causes for Excitement and Concern

In terms of what excites investors, the prospective social impact of psychedelic therapies and their potential as novel and effective treatment options are clear leaders (i.e., a significant portion of investors are fundamentally excited by the challenge at hand, as opposed to being purely returns-driven).

Retail investors are sensitive to the timely achievement of announced clinical trial milestones, but report that these are cause for excitement more than concern.

More institutional-type investors view consolidation as a positive, with excitement around potential M&A opportunities.

Two key concerns were reported among psychedelics investors: regulatory and legislative barriers, and the cost and use of capital. While the former is generally out of the direct control of psychedelics companies, the latter is something that might be partially managed through the sensible (at least in terms of optics) use of funds. Investors are very concerned about the short cash runways many publicly-traded companies have remaining, especially given the relatively difficult fundraising environment at present (and for the foreseeable future).

Explore our thematic analysis, and review indicative quotes from respondents, in the full report.

Access the Full Report

The Psychedelic Investor Pulse Survey Report includes detailed information on investor behaviour, future intentions, value chain segment attractiveness, and thematic analysis of what most excites and concerns investors.

Access the report for free now…