This morning, Compass Pathways shared a readout from the first of two Phase 3 trials investigating its synthetic psilocybin candidate, COMP360, in treatment-resistant depression (TRD). That makes it the first Phase 3 study of a classical psychedelic to print data.

The company reports that the 25mg COMP360 psilocybin arm separated from placebo, with a “statistically significant and clinically meaningful” 3.6-point between-group difference on the MADRS at week 6, the primary endpoint. It also shared the verdict of the Data and Safety Monitoring Board (DSMB), which reported that its latest review of data from both of the company’s ongoing Phase 3 studies revealed “no new or unexpected safety findings”, and that “there is no evidence of a clinically meaningful imbalance between treatment arms in suicidality in either study”.

This is reassuring news for the company, which is also conducting a larger, three-arm study that is due to read out in the second half of 2026. It’s also reassuring for the broader crop of psychedelic drug developers, with many investors and operators closely watching the readout.

We spoke with company execs, who told us they were “extremely happy” with the data, about the news…

***

Reporting by Josh Hardman

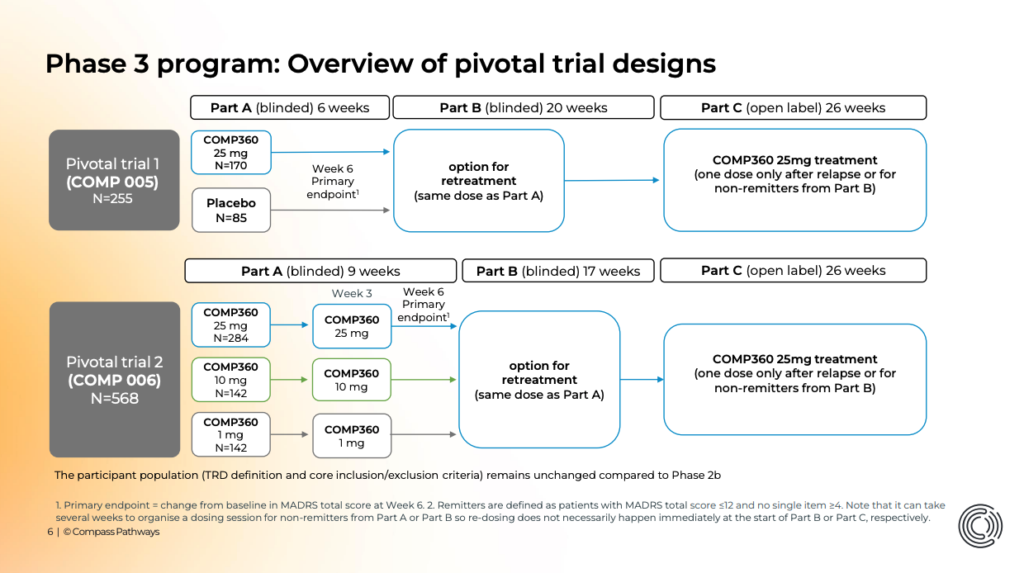

As a reminder, this study sees Compass trial a 25mg dose of its synthetic psilocybin against placebo in 258 patients with TRD (COMP005, NCT05624268). It’s the first Phase 3 study of psilocybin to read out, and the largest of its kind with 32 sites across the U.S. Still, it’s the smaller of the pair of pivotal trials, with the second aiming to enrol 568 patients (COMP006, NCT05711940).

Given the role of functional unblinding in placebo-controlled trials of psychedelics like psilocybin, this study provides more of a safety signal than a clear picture of efficacy. Indeed, FDA’s Draft Guidance on psychedelic clinical investigations notes the following when contemplating, for example, two types of trial design:

“The trial without a placebo could provide information about dose-response without the risk of a nocebo effect. The placebo-controlled trial may raise concerns about functional unblinding but will allow for better characterization of safety signals.”

In fact, what FDA is discussing as an example—a program that has both a trial “using a low, middle, and high dose without a placebo […] paired with a placebo-controlled trial”—is precisely what Compass’ Phase 3 program features.

As reported previously, the readout is a limited one. The company says that is because it’s being attentive to FDA’s general preferences, with Compass “deliberately restricting the information that we receive from the third party”, CMO Guy Goodwin told us. “The less we peek, the better”, he added.

The company has focused the announcement on the MADRS treatment difference between the two arms, with the corresponding p-value and confidence interval. That means we don’t know what the placebo group’s response was, but we do know that these have been highly variable in other studies involving psychedelics. (According to one review, placebo responses in studies of some psychedelics were lower than in those of the SSRI escitalopram, and GH Research’s Phase 2b readout printed a nocebo response.)

Still, it’s a relief for Compass that the limited readout reports separation between the placebo and the 25mg COMP360 psilocybin arms. But it’s more important, given the design of the study and FDA’s stance, that the Data and Safety Monitoring Board (DSMB) reports no evidence of a clinically meaningful imbalance of suicidality between the treatment arms, though it is notable the DSMB chair’s statement refers to data from both COMP005 and COMP006 studies.

Readers will recall that suicidal ideation and intentional self-injury in the 25 mg group of its Phase 2b study generated some concern, which we discussed in our November 2021 coverage. (Though, CEO Kabir Nath said earlier this year that, “even in light of the 2b data, the FDA was still not concerned…they fully understand that this is a core feature of the disease.”)

In the company’s Q4’24 earnings call, Compass Chief Medical Officer Guy Goodwin had shared his expectation that there “will not be important differences [in behavioural actions related to suicidality] between the three arms” that will be trialled in COMP006.

He and his colleagues are reassured by the DSMB’s verdict here, then. “The statement from the DSMB, I have to say, couldn’t have been better as far as we’re concerned”, Goodwin told us, adding that “efficacy is a bonus, we didn’t know which way that would go.” “We’re going to be able to go and talk to FDA with a very clear profile that the safety profile is good, and at this stage that’s the most important part”, he added.

“That DSMB safety statement is so critical for us, even for the class,” Chief Commercial Officer Lori Englebert reiterated.

As mentioned, this limited readout isn’t sufficient to assess the efficacy of the intervention, but it does give us a broad look at its separation from placebo.

While perhaps modest at first glance, a placebo-adjusted MADRS difference of 3.6 is similar to that of Spravato, which was approved with a 3-4 point difference. (It’s tricky to compare this to Compass’ Phase 2b study, which employed the 1, 10, and 25 mg arm design.) The result is highly statistically significant, with a p-value of <0.001.

Earlier this year, Goodwin said that he and his colleagues “would be very pleased to see effects of over 3 on the MADRS scale”, referring to the difference between the active and placebo arms at week 6, adding: “We think that is clinically significant, anything above that is a bonus.”

Others, like Deutsche Bank equity researcher Neen Bitritto-Garg, see commercial relevance arising at a slightly higher placebo-subtracted MADRS change, ~4.5 points at week 6.

“I think there have been analysts who said it should be more than that,” Goodwin told us, presumably alluding to these types of statements, “but actually, we really didn’t know, because, as you know, there are no phase three clinical studies [of classical psychedelics] against placebo, and placebo can either shrink your effect or it can inflate your effect.”

“Coming in at a sort of reasonable level, which is good but not too unbelievable, is, as far as I’m concerned, a win”, he added.

What’s more, Compass is hoping that multiple doses will deliver a greater magnitude of effect. Its second Phase 3 study, COMP006, will test two doses, taken three weeks apart, before a Week 6 primary endpoint.

Englebert also emphasised that the company is testing the intervention in a treatment-resistant patient population. “When Auvelity launched their delta was 3.8 in a broad-based MDD patient population and was met with wild enthusiasm and encouragement”, she told us, adding: “This is TRD and we’re showing 3.6 and that should not be lost on people how important it is in this patient population.”

With this in mind, she said that, compared with Spravato, “we’re already sitting in a very commercially advantageous position”, given the potential for a more patient-friendly dosing regimen. She added that two doses might lead to a higher magnitude of antidepressant effect, and said that “durability is going to be the name of the game.”

With those expectations in mind, today’s readout provides reassurance on the safety front along with a modest efficacy signal.

Article continues below advertisement…

Focus Turns to Larger, Multi-Dose Trial and U.S. Commercial Launch

Having established separation from placebo at week 6 and a reassuring safety signal, at least according to the limited readout, all eyes now turn to Compass’ second Phase 3 study, COMP006 (NCT05711940). (In fact, Englebert described COMP005 as “almost a teaser” for this second study.)

That second trial is much larger, with 96 sites across North America and Europe and more than double the enrolment target of the first. What’s more, given its three-dose design (which is the same as employed in its Phase 2b study, Goodwin et al., 2022), it will provide a much clearer picture of the effect of COMP360 on TRD. It will also trial two doses in the 9-week ‘Part A’ element, providing a look at the effect of a subsequent dose on early patient outcomes.

Compass believes that this COMP005 data will accelerate recruitment into COMP006. “005 was subject to two delays and was a real concern for us”, Goodwin explained, adding that this readout might provide a morale boost to principal investigators across the 100-odd trial sites. “It’s really the enthusiasm that you experience when you talk to PIs…they feel part of something that’s important, not just kind of fulfilling a mercenary role”, the CMO told us, adding: “So that morale boost that we think this will give them is significant”.

Englebert, meanwhile, described it as “validation for the class”.

26-week data from that trial is expected in H2’26, with 26-week data from COMP005 expected to be shared once the 9-week ‘Part A’ portion of COMP006 is complete. If all goes well, Compass could be submitting its New Drug Application (NDA) with the FDA shortly thereafter.

Should that NDA be granted, Compass would then have the mammoth task of launching the drug, which is delivered with psychological support, in the U.S. In doing so, it could have a first mover disadvantage, in that it will have to put in enormous legwork to prepare the healthcare field—from patients and practitioners through to payors—to integrate and deliver its unorthodox treatment.

But with new leadership at Lykos Therapeutics apparently hoping to resubmit their MDMA for PTSD NDA without conducting a fresh Phase 3 study, Compass might not be the only psychedelic drug developer shaping the market in the next couple of years.

What’s more, Compass has already taken steps to begin that work, having inked partnerships with the likes of Greenbrook TMS, HealthPort, and Hackensack Meridian Health to hone the model. Additionally, earlier this month the company listed several new job openings for its U.S. team with a range of commercialisation-related roles such as those in the realms of product, manufacturing and supply, real-world data, and so on.

Englebert said that she thinks the company will continue to post, “hopefully at a fairly rapid pace”, commercial-related roles. “That will be a real signal that we’re moving towards preparation”.

But even if Compass plays its cards right and successfully launches its COMP360 psilocybin therapy, there are dozens of shorter-acting psychedelic candidates nipping at their heels, which could confuse COMP360’s commercial and clinical profile, should they also come to market in the coming years.

Regardless of what lies ahead, today’s readout from Compass goes some way to derisking its psilocybin candidate and justifying its ongoing larger, three-arm pivotal trial.

Pα: This positive readout is a win for Compass and a reassuring signal for the field.

While the limited nature of the topline data, coupled with the placebo-controlled study design, caps what we can infer, the reassuring readout on the safety front and separation from placebo is all that Compass might have hoped for here.

“This particular study was always a worry to us,” Goodwin told us, noting that it “was very slow to take off”. He also worried that its placebo-controlled design could mean it might not be taken seriously. “Its real purpose is the safety side”, he insisted, which means the readout is certainly positive—especially since concerns around safety sunk the company’s stock when it announced its Phase 2b results in 2021.

Now, all eyes turn to COMP006, the three-arm study, which is expected to read out in H2’26 and should give a much clearer look at the intervention’s efficacy as well as substantially increasing the N and thus improve our understanding of its safety profile. The company is presumably keeping its fingers and toes crossed for a more convincing display on the efficacy front in this second, larger study, which sees patients dosed twice before the 6-week primary endpoint.

The focus also remains on the U.S. market, with an FDA submission the company’s primary target. With that in mind, Compass will share this data with the agency, but a decision on when to share it with the European Medicines Agency or the UK’s MHRA has not yet been made, according to company execs. “We’re taking one step at a time”, Goodwin told us, adding that Compass would communicate with the FDA first and then, “once that is done, turn attention to Europe.” “To be honest”, he continued, “that hasn’t been a priority”, though he said that this would change once it’s “sorted out our immediate need” with regards to the FDA.

Its focus also remains substantially on TRD, though Goodwin said that the company is on track to sign contracts with a CRO before year-end to begin a PTSD study.

On the regulatory front, while some believe that Lykos Therapeutics is set to benefit from changes in health-related leadership in the states, Compass isn’t banking on it. Englebert said that the company is, however, “definitely encouraged by the signals we’re seeing”. “We’ll of course request a meeting with FDA to discuss these results and more results as they come, and if there is a door that potentially opens a pathway to accelerate, then of course we push on it”, Chief Patient Officer Steve Levine told us.

“Two out of two is not bad”, Goodwin said, referencing the company’s positive Phase 2b study and the present readout, adding: “We have a third cooking”. “Rest assured, we’ve got something pretty special here”, Englebert added.

In the coming days, we will share reactions to the news from across the field. ∎