Looking Ahead to a Psychedelic 2022

Part of our Psychedelics 2021: A Year in Review Series

2022 looks set to be another busy year for the psychedelics space, with a number of late-stage clinical trials commencing or wrapping; important decisions on the table for Oregon’s legal supervised psilocybin therapy rollout in 2023; further (psychedelic) drug policy reform efforts set to progress; and much, much more.

Rather than making cold, hard predictions about what’s sure to be a very psychedelic 2022, we’re going to share some key trends that we’ll be keeping an eye on, and covering, in this new year.

But first, let’s take a look back at our 2021 ‘predictions’…

Our 2021 Predictions: How Did We Do?

Last year we published a much shorter Year in Review for 2020, which included a Looking Ahead section where we made some broad suggestions of what we might expect to see in 2021. So, how did we do?

Let’s take a look at each broad ‘prediction’…

There are plenty of catalysts on the horizon as we enter a new year, including clinical trial readouts from COMPASS Pathways’ Phase 2b psilocybin-for-depression study and ATAI Life Sciences’ expected IPO. We should also see MAPS continue to make progress in their Phase 3 investigations into MDMA-for-PTSD, which appear promising thus far. Should the clinical data from these trials continue to indicate the safety and efficacy of psychedelics such as psilocybin and MDMA, it is likely to continue to propel interest and activity in the broader space.

Well, that was an easy prediction, and one that came true (at least to some extent). As mentioned in our earlier section on Psychedelic Research and Clinical Trials in 2021, data readouts from COMPASS Pathways’ Phase 2b and MAPS’ Phase 3 study did attract a great deal of mainstream attention. So too did atai Life Sciences’ Nasdaq IPO.

However, on the investor side of the equation COMPASS’ readout and atai’s IPO did little to bolster confidence in the companies’ valuations. As aforementioned in this series, both companies’ stocks have performed poorly in 2021, reflecting (and perhaps even leading) the broader psychedelics market downtrend: it seems that capital letters are not the only type of capitalisation atai reduced during 2021 (the company name was formerly styled ATAI Life Sciences).

We also expect to see access to psychedelics, notably psilocybin, continue to expand via progressive moves from local governments (urged by grassroots campaigns) and national regulatory bodies such as Health Canada. The combination of bottom-up grassroots advocacy and top-down regulatory amendments may generate a reinforcing cycle that gradually expands access to psychedelics in both a geographical sense, but also in terms of access criteria. We may even see a national legal framework for psilocybin emerge in Canada next year. It is likely that local decriminalisation and legalisation measures in the United States will follow a similar timeline as marijuana, with states such as California next in line for such measures. We anticipate a continuation of the current trend whereby some psychedelics companies publicly state their ambitions to enter these regionally-legalised markets (e.g., Field Trip in the case of Oregon), while others intend to steer clear of entering state markets so long as psychedelics remain federally illegal (e.g., MindMed in the case of Oregon).

You could argue that this was another easy prediction for us to have made back in December 2020. Nonetheless, we are taking this one as a win.

As you can see in our Psychedelics Legalization and Decriminalization Tracker, psychedelic drug policy reform is now prolific in the United States, with a great number of bills emerging in 2021. A prime example being California’s SB 519 which, though put on hold, aims to decriminalize a range of psychedelics in the Golden State.

We didn’t see the type of national legal framework for psilocybin emerge in Canada that we may have alluded to, but we have seen important reforms to the nationwide Special Access Programme which could afford individuals access to psychedelic-assisted therapies.

And, amid all of these psychedelic drug policy reform developments, many psychedelics companies have attempted to capitalise on the newfound attention and regulatory loosening by press releasing their support for amendments, motions, and movements.

Read our Psychedelic Drug Policy Reform in 2021 section for more on the above topics.

We expect that mainstream media will increasingly cover developments from the psychedelic space. This coverage of psychedelics will increasingly contribute to conversations regarding the mental health crisis, which we expect to remain a salient issue given the ongoing impact of COVID-19. Societies across the world have been forced to confront shortcomings in mental health provision, which should catalyse efforts to discover and deliver alternative treatments.

Another easy one, which unsurprisingly came true. As aforementioned, media coverage was stoked by MAPS’ Phase 3 results and psychedelic drug policy reform efforts, among other catalysts. See our section on Psychedelic Perceptions in 2021 for more on this topic.

Technology and digital therapeutics should play an increasing role in the work of psychedelics companies, from augmenting drug discovery by employing AI, right through to empowering end-users of psychedelic therapies and medicines by providing actionable insights through the use of wearables.

This one certainly rang true. Check out the segment Growth of Digital Therapeutics, Delivery Technologies & Drug Discovery Tech in our earlier section for more on this.

From a financial point of view, we expect money will continue entering the space in large sums, with ATAI’s expected IPO representing an important date in the psychedelics financial calendar for 2021. We may also see greater M&A activity in the space next year, and interest from the more conventional pharma industry is likely to increase. We also expect some companies in the space to continue seeking out shorter-term revenue streams. Clinics and wellness centres offering ketamine treatment programs are likely to continue to be a dominant trend, along with consumer packaged goods such as nutraceuticals.

A mixed bag, here. While large sums of money have continued to flow into the space, the story on the public markets has been much less rosy: atai’s IPO, for example, proved to be a damp squib that failed to lift the psychedelics market.

M&A activity didn’t materialise in any substantial way. We will be shamelessly rolling over this prediction into our 2022 batch: more on that below.

We anticipate the pace of press releases and announcements from psychedelics companies to continue increasing, particularly in relation to intellectual property (e.g., patent filings) and research and development (including clinical trials). As with any nascent sector, there will also be a great deal of noise that threatens to obscure the underlying value in any given company or project.

Tell us about it! It’s been quite the year in terms of the pace of company news and research publications.

Now let’s look ahead to 2022…

Trends to Follow in 2022

As aforementioned, we’re sharing some of the key trends we will be following, and writing about, in 2022. As always, this is by no means exhaustive…

Psychedelics R&D Moves Beyond Mental Health

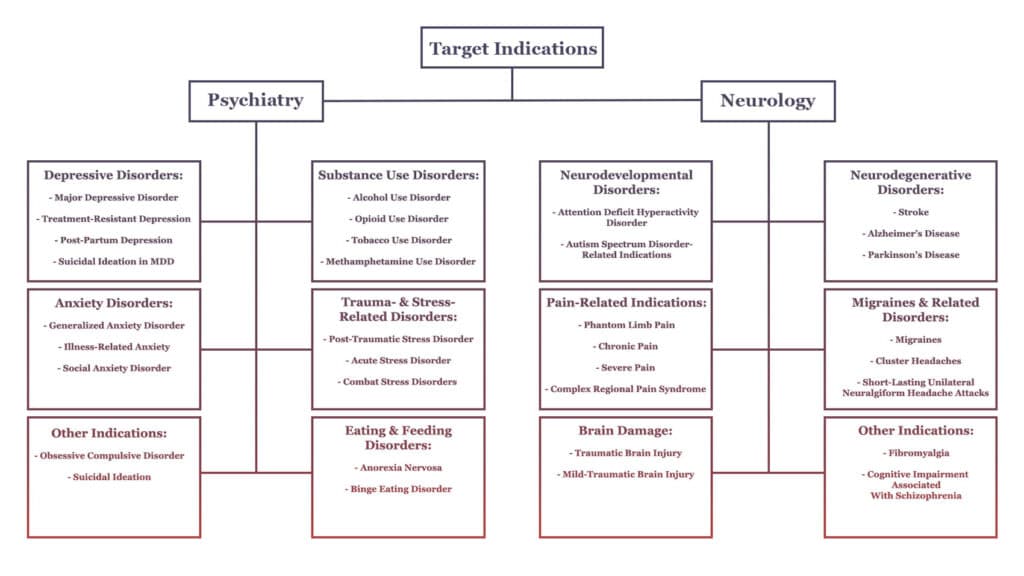

While mental health conditions like depression and PTSD have represented the beachhead for clinical research into psychedelics, we’re now seeing more investigations geared toward treating a broader set of conditions such as neurodegenerative disorders and pain-related indications.

The figure below (reproduced from our earlier section on Psychedelic Research and Clinical Trials in 2021) visualises a number of these target indications.

Should psychedelics’ effects on structural and functional neuroplasticity and inflammation continue to be validated through research, we might expect them to prove efficacious (with or without the ‘trip’) in the treatment of at least some of the conditions outlined above.

A number of review articles published in 2021 expanded on this potential, including Albert Garcia-Romeu et al.’s exploration of psychedelics as potential novel therapeutics for Alzheimer’s disease, and Saeger and Olson’s survey of psychedelic-inspired approaches for the treatment of neurodegenerative disorders more broadly.

We’re already seeing a number of research labs and companies seek to develop psychedelic drugs for the treatment of many of these conditions, and we should expect more of this work to emerge in 2022. A small portion of this work will enter clinical trials in 2022.

As mentioned earlier in this report: we must be cautious not to overstate the ‘promise’ of psychedelics to treat such diseases. While psychedelics appear to work in a transdiagnostic manner, much of the research is in early stages, particularly around this broader list of conditions.

This broadening of the research and drug development pipeline to include a whole swathe of new conditions certainly makes it more difficult for investors, analysts, and other observers to make an informed appraisal of any particular drug development programme. Now, not only must interested parties have a grasp of the broader context of neuropsychiatric research and drug development, but also that of fields such as Alzheimer’s research, which brings with it a whole new field of debates, varying degrees of (un)certainty in terms of drug targets, and more.

One thing’s for certain: it’s going to get a lot more difficult to keep tabs on the breadth and variety of the psychedelic drug development pipeline in 2022.

The ‘Psychedelic Patent Wars’ Rage On

The ‘patent wars’ will be stoked by an acceleration of patent application publications, with potential grants, rejections, and litigation.

The Intellectual Property (IP) landscape of the psychedelics space is becoming clearer week-by-week as companies announce filings, patent applications publish, and IP offices hand down their verdicts.

As mentioned in the preceding section, the patenting of psychedelics and their related technologies and uses has not been without controversy. At the close of 2021, the non-profit Freedom to Operate filed two petitions for post-grant reviews of COMPASS Pathways’ patents, supported by research conducted by a group of crystallographers. This case alone will be one to watch as we enter 2022, with COMPASS expected to respond in the coming months, and a potential trial thereafter.

It’s unlikely this will be an isolated case, though. Many patent applications will be published in 2022, with the 18 months of secrecy attached to many such filings expiring this year. This means that by the end of 2022, we should have a much clearer picture of the psychedelic intellectual property topography, which may have impacts on drug development pipelines and research activity.

Is Consolidation on the Cards?

As aforementioned, we expected some level of consolidation in 2021, but this didn’t play out in any substantial way. At risk of a double fault, we’re rolling this prediction over into 2022.

If the broader economy, biotech sector and public markets continue to flag in 2022, we could see an untenable environment for a number of publicly-traded psychedelics companies. We’re not alone in predicting that there will be a number of companies that fold in 2022: MINDCURE CEO Kelsey Ramsden goes as far to suggest that half of the psychedelics companies with a sub-$300m market cap (a category in which her company sits) will “die” in the coming year.

MAPS’ Rick Doblin, meanwhile, told us that he expects a “major” consolidation of the for-profit psychedelic companies, “with many running out of money or seeing their ideas not borne out once actual research is started.”

But, going bust isn’t the only way that the sector might be reorganised. A less pessimistic prediction is that we will see a greater level of mergers and acquisitions (M&A) in 2022, both from companies outside the psychedelics space, and from within.

Intra-industry acquisitions may be driven by public companies with relatively large sums of cash on hand. As of September 2021, atai had just over $430m cash on hand, while COMPASS and MindMed had around $294m and $146m, respectively.

Indeed, atai was busy in 2021 when it came to launching new programs and making strategic investments, with 6 such deals made. Though, it remains to be seen how substantive each of these are.

We might also expect companies outside the psychedelics space to make acquisitions of psychedelics companies or programs in 2022. Some smaller psychedelics companies may be acquired by larger ones operating in ‘adjacent’ industries, such as cannabis, as was the case with MagicMed Industries which was acquired by Nasdaq-listed CBD biotech Enveric Biosciences in 2021.

Though perhaps more of a stretch, we might even see companies in the broader biotech and pharmaceutical industry acquiring psychedelics companies and programs. After all, Otsuka Pharmaceutical has already invested in and partnered with a handful of companies and drug candidates in the space.

A Closer Eye on Insurance Coverage

As MAPS’ MDMA-AT for PTSD nears potential approvals, and COMPASS Pathways enters Phase 3 trials, we will see a greater focus on the cost-effectiveness of psychedelic-assisted therapies and the willingness of insurance companies to cover these novel treatments in 2022.

This is a key priority for MAPS, with Founder Rick Doblin telling Psilocybin Alpha that “a key challenge in 2022 will be the early negotiations with insurance companies for possible coverage of psychedelic-assisted therapies post-approval for prescription use.”

Elliot Marseille, lead author of a 2020 paper that sought to demonstrate the cost-effectiveness of MDMA-AT for the treatment of PTSD, serves as Director of a dedicated initiative housed at UC Berkeley and UCSF. The Global Initiative for Psychedelic Science Economics (GIPSE) is a network of health economists with the shared goal of increasing access to psychedelic therapies by demonstrating (and improving) their cost-effectiveness. The group is working with MAPS as well as the Usona Institute and others.

Insurance coverage will be key to ensuring a scalable and accessible roll-out of psychedelic-assisted therapies. We will be keeping a close eye on this trend, and groups like GIPSE and companies like Enthea, in 2022.

All Eyes on Oregon

The two-year development period for the Oregon Psilocybin Services section ends December 31, 2022. That means that by the end of this year the Oregon Psilocybin Advisory Board must be in a position to implement the regulation of the manufacture, transportation, delivery, sale and purchase of psilocybin products and the provision of psilocybin services in the state. Applications for licences begin January 2, 2023: there’s no wiggle room.

That’s a hefty task, and it won’t be without debate. Key fault lines include whether microdosing should be included in the provision, to what extent advertising should be permitted, and more. As a recent article on the matter pointed out, the clock is ticking: the Board has until the end of June to send their recommendations to the Oregon Health Authority.

Interested parties should follow these debates closely; we certainly will be.

Other (Psychedelic) Drug Policy Reform Efforts Continue

When we said ‘all eyes on Oregon,’ we didn’t mean to take your attention away from the slew of other (psychedelic) drug policy reform efforts that will develop throughout 2022.

Perhaps most notably is California’s SB 519, which would decriminalize a number of psychedelics in the Golden State. The Bill was put on pause in 2021, but is set to be re-introduced this year.

Emerge Law’s Sean Clancy is, unsurprisingly, following this trend closely (not least to keep the Psychedelics Legalization and Decriminalization Tracker up-to-date along with the team at Calyx Law). He told us that in 2022 he expects “more local measures and perhaps more ambitious state-wide measures, especially from newer, creative politicians seeking to set themselves apart by following Oregon’s bold lead to decriminalize personal possession while regulating specific compounds, such as psilocybin.”

As we expect to see decrim. and legalization initiatives continue apace in 2022, we might also expect to see a greater need for harm reduction efforts. Rick Doblin told us that MAPS’ Psychonaut training in psychedelic harm reduction and peer support will launch for the general public in 2022, just one such initiative.

Other Trends to Follow in 2022

While we couldn’t possibly cover every trend that’s worth following in 2022, here are several others to keep in mind:

- Psychedelics companies and researchers continue to explore digital therapeutics and innovative tech across the drug development pipeline and patient journey.

- Might we see conventional drug developers expand their pipelines to include psychedelics?

- We’ll see plenty of failures in 2022, with a number of preclinical and clinical studies wrapping. Research has shown that Phase II trials have the highest attrition rates out of all clinical stages, and there are plenty of Phase II trials underway in psychedelics.

- The debate around the rigour of trials will continue.

Taken together, many of these trends point toward a changing regulatory, scientific, and financial landscape for psychedelic researchers, practitioners, and (in particular) companies. Pivot or perish will likely be a scenario that a number of these companies face in 2022.

Trends to Follow in 2022

In our Psychedelic Research and Clinical Trials in 2021 section we discussed a handful of publications and readouts that occured over the course of last year. While some of these results, such as MAPS first Phase 3 results, drew a great deal of positive attention to the space, others served to temper expectations somewhat.

Below are a sample of clinical trials that, barring any delays, we might expect to see progress from over the course of this year.

Various Trials Finishing or Expected Readouts In 2022

- MAPS | Phase 3 (#2) | MDMA-AT for PTSD (NCT04077437)

- Rick Doblin tells Psilocybin Alpha that MAPS has already enrolled 71 of the 100 participants needed for the second Phase 3, and that interim analysis will provide results in May 2022.

- Doblin told us that the study is expected to conclude in November 2022. Should these results be statistically significant, and no novel safety issues emerge, MAPS will finalise its New Drug Application (NDA) with the FDA.

- MAPS will also seek to broaden its footprint geographically, buoyed by a recent fast-track designation from UK regulators. “MAPS will complete the training of about 40 therapists in 6 countries and 9 sites in England and Europe who will be conducting Phase 3 research into MDMA-assisted therapy for PTSD,” Doblin explained. He added, “we’ll train another 800 or more therapists in MDMA-assisted therapy for PTSD.”

- Usona Institute | Phase 2 | Psilocybin for Major Depressive Disorder (NCT03866174)

- MindMed | Phase 2a | LSD for Anxiety Disorders (NCT03153579)

- MindMed | Phase 1 | 18-MC Safety and Pharmacokinetics (NCT04292197)

- Perception Neuroscience (atai Life Sciences) | Phase 2 | R-Ketamine for Treatment-Resistant Depression (2020-005457-25)

- GABA Therapeutics (atai Life Sciences) | Phase I | Deuterated Etifoxine Safety and Pharmacokinetics (ACTRN12621000160831)

- DemeRx (atai Life Sciences) | Phase 1 of Phase 1/2 | Oral Ibogaine Safety and Pharmacokinetics (NCT05029401)

- Beckley Psytech | Phase 1 | 5-MeO-DMT Safety and Pharmacokinetics (NCT05032833)

- Beckley Psytech | Phase 1b | Psilocybin for SUNHA (NCT04905121)

- MindMed (UHB) | Phase 1 | DMT Effects in Healthy Subjects (NCT04353024)

- MindMed (UHB) | Phase 1 | Effects of LSD-MDMA Co-Administration (NCT04516902)

- Yale University | Phase 1 | DMT Safety and Efficacy for Depressive Disorders (NCT04711915)

- Yale University | Phase 1 | Psilocybin Safety and Efficacy for Cluster Headaches (NCT02981173)

- University of Arizona | Phase 1 | Psilocybin for Obsessive Compulsive Disorder (NCT03300947)

- MAPS | Phase 2 | Comparing 2 Versus 3 Active MDMA-AT Sessions for PTSD (NCT04784143)

- Yale University | Phase 1 | Psilocybin Safety and Efficacy for Concussion Headaches (NCT03806985)

- University of Alabama at Birmingham | Phase 2 | Psilocybin for Cocaine Use (NCT02037126)

Various Trials Expected to Begin In 2022

- COMPASS Pathways | Phase 3 | COMP360 Psilocybin for TRD (Announced or Expected)

- COMPASS will be the first for-profit company to take a classic psychedelic into a Phase 3 trial this year, following the conclusion of its 2b trial in 2021.

- MindMed | Phase 2b | LSD for Generalized Anxiety Disorder (Approved)

- Mydecine (Johns Hopkins) | Phase 2/3 | Psilocybin for Smoking Cessation (Announced or Expected)

- MindMed | Phase 2 | 18-MC for Opioid Withdrawal (Announced or Expected)

- Perception Neuroscience (atai Life Sciences) | Open-Label | R-ketamine Drug-Drug Interaction Study (Announced or Expected)

- Tryp Therapeutics | Phase 2 | Psilocybin for Binge Eating Disorder (NCT05035927)

- Field Trip | Phase 1 | 4-HO-DiPT Safety and Pharmacokinetics (Announced or Expected)

- Tryp Therapeutics | Phase 2 | Open-Label Study of Psilocybin-AT for Fibromyalgia (NCT05128162)

- University of Washington | Phase 1/2 | Psilocybin for Front Clinician Depression and Burnout (NCT05163496)

- Ottawa Hospital Research Institute | Phase 1/2 | Psilocybin for Psychological and Existential Distress in Palliative Care (NCT04754061)

- University of Fribourg | Phase 1 | Effect of LSD on Neuroplasticity (NCT05177419)

Closing Remarks

We hope that this report has offered an overview of some of the most salient events and trends in psychedelics last year, from fundamental research and clinical trials through to policy reform and pop culture.

Throughout 2022 we will continue providing news and analysis as well as trackers and resources that allow you to keep tabs on psychedelic patents, policy reform, and more. We are proud that in 2021 these resources were cited in a range of mainstream outlets including Vox, Newsweek, Business Insider, VICE, Wired, Rolling Stone and Mother Jones.

Today, the publication of research, filing of patents and penning of popular media stories covering psychedelics is growing exponentially. So much so, just keeping tabs on this space and identifying reliable sources—or, ‘cutting through the noise’—is an endeavour in itself.

That’s why we appreciate you, our readers, for your ongoing trust, support and engagement.

Here’s to a very psychedelic 2022!