Given that we have been away for a couple of weeks, this Bulletin is chock-full of news and analysis of recent events…

This Week:

- 🛒 Beckley Psytech Acquires Eleusis – Our Quick Analysis

- 🧬 Empyrean Neuroscience Scoops $22m Series A to Genetically Engineer Small Molecule Therapeutics from Fungi and Plants

- 📊 DEA Increases Production Quotas for Psychedelics, Again

- 🤿 Deep Dive: COMPASS Pathways Reveals Phase 3 Trial Design

- ⚖️ Alberta Will Be First Canadian Province to Regulate Psychedelic Therapy

- 🐨 Australian Capital Territory Decriminalises Small Amounts of Psilocybin, MDMA, LSD, Others

- 🪧 Two Oregon Counties See Campaigns to Oppose Psilocybin Opt-Out Initiatives

- 🏦 NIDA Grant Opportunity

and lots, lots more…

Psychedelic Sector News

Breaking: Beckley Psytech Acquires Eleusis

Editor’s Note: This news broke just as we were going to publish this Bulletin. As such, below is our quick take; it’s certainly not exhaustive.

It was rumoured for some time, but now it’s official: Beckley Psytech has acquired Eleusis.

The two British companies have long histories of involvement in psychedelic research and business. The former is the latest in a series of both charitable and for-profit ventures stemming from the Oxford-based Beckley Foundation, headed up by Amanda Feilding (see our July 2020 interview with Beckley Psytech’s founder for more background). The latter, Eleusis, is headquartered just 60 miles down the road in London, and claims to be one of the first psychedelic drug development startups.

Indeed, when we spoke to Eleusis CEO Shlomi Raz (who will now take up the position of Chief Business Officer at Beckley) back in June 2020, he was keen to remind us that his company is one of the oldest in the game. According to Raz, given that Eleusis was founded in 2013, it was “the world’s first company dedicated to the transformation of psychedelics into medicines.”

The company began as a joint enterprise between ex-Goldman Sachs managing director Raz and renowned psychedelics researcher Charles Nichols. Back then, Raz was keen to tell us about the company’s dual focus on both the psychiatric applications of psychedelics, but also on their apparent anti-inflammatory potential. This latter facet was inspired by Nichols’ work, which has attempted to uncover the potent anti-inflammatory effects of 5-HT2A agonists (see Flanagan and Nichols, 2018, for a brief review).

You can see this dual focus reflected in the company’s Pipeline webpage from March 2021 where we see five candidates with indications ranging from adjunctive treatment of major depressive disorder right through to ocular inflammation, peripheral inflammatory disease and Alzheimer’s.

Fast forward to January of this year, and you will see that the pipeline page has received a substantial haircut. Just one asset remains: ELE-Psilo, or ELE-101. (Note: the indications for this asset were previously “Major Depressive Disorder and Treatment Resistant Depression”, but this has now been replaced by simply, “Depression”. Given that Eleusis, and now Beckley, is putting this candidate through a Phase 1 trial, they need not disclose a specific indication just yet.)

It seems that this ambitious pipeline wasn’t met with ample resources. In January, after the company had doubled-down on its lead candidate, the company announced a SPAC that it hoped would raise $288m and result in a NASDAQ listing. Unfortunately for Raz et al., they couldn’t have timed it worse: the biotech, psychedelics and SPAC markets were cratering. In June, the company scrapped the SPAC.

And so, ELE-101 is what Beckley Psytech is substantially acquiring, an IV formulation of psilocin being developed under the candidate name ELE-101. By cutting out the prodrug (psilocybin) and skipping straight to IV administration of the active metabolite itself, Beckley will hope that this formulation proves to deliver a more consistent and predictable response in patients. The onset of effects will likely be faster and the duration of treatment shorter, which could have obvious benefits in terms of convenience and cost. Indeed, it fits logically into Beckley Psytech’s focus on short-acting psychedelics, seen at its extreme in its development of a 5-MeO-DMT asset, BPL-003.

It’s also logical, then, that Beckley is dropping its oral psilocybin for Short Lasting Unilateral Neuralgiform Headache Attacks (SUNHA) program. While the company just announced this today via press release, the trial’s termination was reflected on its ClinicalTrials.gov entry earlier this month.

Beyond ELE-101, Beckley will gain some team members from Eleusis, including its R&D team. They will also gain access to a library of novel compounds, but there’s little detail on this.

Our major question is: does this R&D team include Charles Nichols, the scientific founder of Eleusis? There’s no mention of Nichols in the press release, nor of his work on indications beyond psychiatry. If he were joining the Beckley ecosystem you would think it would be press release-worthy (or, website-worthy).

Our bet is that Nichols is a free agent, but whether rights related to his work on 5-HT2A agonists as potent anti-inflammatory agents are locked up in the deal is yet to be seen. This author would certainly like to see that body of work given the attention and resources it deserves.

Empyrean Neuroscience Scoops $22m Series A to Genetically Engineer Small Molecule Therapeutics from Fungi and Plants

Empyrean Neuroscience is the latest psychedelic drug developer on the block. Psychedelic Alpha’s Noah Smith takes a look at the new company…

Earlier this week, the latest psychedelic drug development company launched: Empyrean Neuroscience. In its inaugural press release, the latest entrant described itself as “a genetic engineering company dedicated to developing neuroactive compounds to treat neuropsychiatric and neurologic disorders.” The company, based out of the U.S. and U.K., also disclosed that it had recently secured $22 million in funding through a Series A financing round led by a private investment group, ‘Spore Partners’.

Empyrean is headed by CEO Dr. Usman Azam and CMO Dr. Fred Grossman, both of whom have a great deal of experience in the pharmaceutical industry. In particular, Dr. Azam was previously involved in development programs in the field of genetic engineering and gene therapies through his time at Tmunity and Novartis. Scientific advisory members William Porter, Hesseini Manji (who was heading up Janssen’s neuroscience efforts when Spravato was under development), and Francis Lee look set to support the company’s research and development efforts.

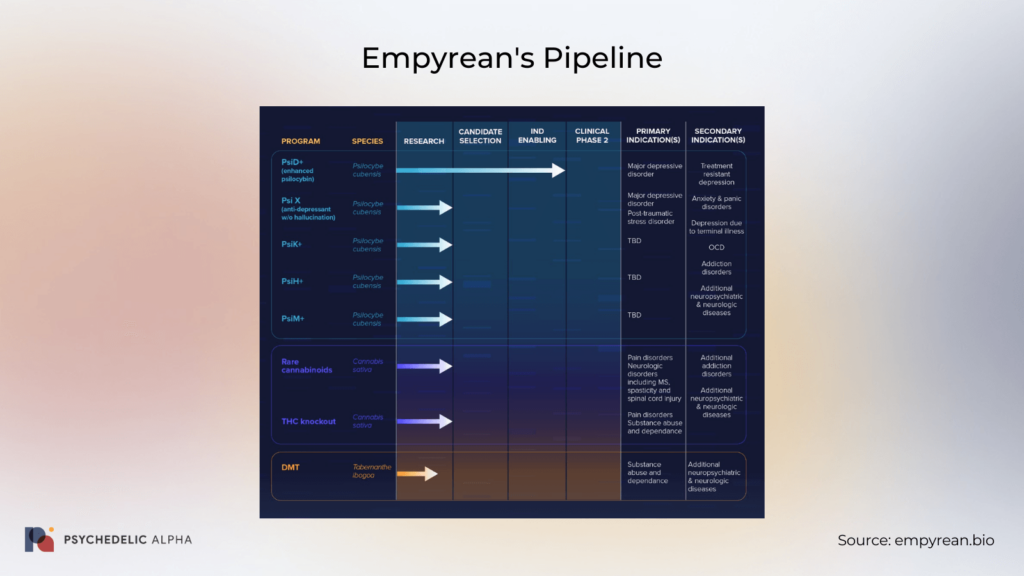

Empyrean’s pipeline features several development programs focused on optimising and advancing different species of plants and fungi in the hopes of treating a swathe of psychiatric and neurological disorders. The company’s broad (and certainly ambitious) research focus includes investigations into its “neuroactive compounds” for indications such as PTSD, MDD, OCD, anxiety disorders, substance use disorders, pain disorders, and more.

Currently, Empyrean is working to develop treatments by making genomic modifications to known species, including Psilocybe cubensis, Tabernanthe iboga, and Cannabis sativa. Indeed, Empyrean’s core value proposition appears to revolve around its genetic engineering platform, which the company believes will support the creation of improved and/or novel compounds. Specifically, the company anticipates being able to use genetic engineering to alter the concentration and type of neuroactive compounds produced by plants and fungi.

One of Empyrean’s recently published patent applications elucidates how these innovative methods may allow the company to deliver on its aim of “enhancing nature through science.” The application, titled “Genetic Engineering of Fungi To Modulate Tryptamine Expression”, describes how fungi can be genetically modified to “increase the production of one or more tryptamine”, such as psilocybin. These methods may eventually prove to be an alternative means of creating safer or more effective treatment options.

“Genetics and bioinformatics capabilities allow us to up-regulate and down-regulate genes and knock-out and knock-in genetic payloads to modify the neuroactive compounds that are created by fungi and plants.” – Empyrean website.

Empyrean’s development pipeline comprises eight programs related to three different species of plants and fungi. While most of the company’s development efforts are still in the early stages of research, Empyrean is currently conducting IND-enabling studies for its PsiB+ “enhanced psilocybin” program. This “genetically engineered encapsulated mushroom drug product” will first be studied as a treatment for MDD. Based on discussions with the FDA, Empyrean anticipates being able to initiate a Phase 2 clinical trial of its PsiB+ candidate at some point in 2023.

In contrast to many other drug developers working with synthetic or more isolated formulations of pure psilocybin, Empyrean intends to provide treatments using entire psilocybin-containing mushrooms. The company has suggested that this approach may allow it to leverage an entourage effect resulting from synergies with other constituents naturally produced by the fungus.

Traditionally, the term “entourage effect” has been used in reference to the hypothetical synergies between THC and other compounds found in cannabis that are thought to be able to modulate its therapeutic effects. Lowe et al. (2021) describe the crux of this theory, stating:

“the sum of the contributing parts of a botanical or biological system produce a greater, synergistic effect in comparison to the effect of each individual part when presented alone.”

Given the presence of many other bioactive compounds in natural psychoactive mushrooms, it is probable that some synergism between constituent compounds would exist. However, it remains unclear whether these resulting effects could produce a superior therapeutic benefit compared to isolated forms of psilocybin. Nonetheless, Empyrean’s work using genetically engineered plants and fungi may help shed more light on these unresolved questions.

DEA Increases Production Quotas for Psychedelics, Again

In a notice published in the Federal Register on October 18, DEA revealed that it is again increasing proposed production quotas for a number of psychedelics. Notably, 5-MeO-DMT, LSD, mescaline and psilocin all saw substantial increases.

DEA noted that there has been “a significant increase in the use of schedule I hallucinogenic controlled substances for research and clinical trial purposes.” The administration goes on to explain, “DEA supports regulated research with schedule I controlled substances, as evidenced by increases proposed for 2023 as compared with aggregate production quotas for these substances in 2022.”

COMPASS Pathways Reveals Phase 3 Trial Design

Psychedelic Alpha’s Noah Smith takes a look at the heavily anticipated Phase 3 trial design…

Earlier this month, COMPASS Pathways hosted its Virtual Capital Markets Day. The ~2-hour presentation gave attendees an updated look at the company’s progress, plans, and strategy moving forward.

Through the event, COMPASS shed new light on its much-anticipated Phase 3 development program. These details come almost a year after the company published topline results from its Phase 2b trial of COMP360 psilocybin therapy for treatment-resistant depression (TRD) and nearly four years after the company announced it had received breakthrough therapy designation (BTD) from the FDA. The Phase 3 program, which is set to kick off later this calendar year, is likely to be one of the last hurdles COMPASS needs to clear before it can submit a complete NDA package to the FDA.

But, before digging into the details of the company’s upcoming Phase 3 program, let’s step back and briefly revisit COMPASS’ most recent development milestone, the now-completed Phase 2b clinical trial.

***

A Look Back

Late last year, we deconstructed the company’s Phase 2b trial results in a special edition of the bulletin. In that issue, we covered a range of topics related to the treatment population, the preliminary evidence of efficacy, concerns related to the safety and tolerability of COMP360, and more. While we won’t go into such exhaustive detail this week, here are a few important pieces of information that may be helpful for this overview.

Recap: What Is COMP360 Psilocybin Therapy?

COMP360 Psilocybin Therapy consists of the company’s synthetic psilocybin product along with psychological support provided by trained practitioners, augmented by digital tools for patients and providers. As such, it is important to remember that, like many other psychedelic therapy drug developers, COMPASS is advancing more than just a pharmacological intervention for TRD.

The below slide, shared at the Capital Markets Day, further disaggregates the elements of “psychological support” provided as part of COMP360 psilocybin therapy. While this is, in broad strokes, similar to other psychedelic-assisted therapy protocols, COMPASS’ “psychological support” is likely to be far less therapy-intensive as, say, MAPS’ MDMA-assisted therapy for PTSD protocol which includes over forty hours therapist facetime.

Recap: What is TRD?

Several ongoing trials are now evaluating psychedelics as potential treatments for individuals suffering from major depressive disorder (MDD), including Usona Institute’s psilocybin for MDD study that’s in Phase 2b. However, the patient population targeted in COMPASS’ Phase 2b trial consisted of individuals diagnosed with a more enduring form of the disease, treatment-resistant depression (TRD).

As its name implies, TRD is a diagnosis generally given to patients that have not achieved remission or an adequate response following two or more different treatments (Al-Harbi, 2012). Unfortunately, as Dr. John Rush explained during the presentation earlier this month, treatment intolerance appears to accumulate through successive stages of treatment augmentation or substitution, resulting in diminishing returns for patients and their providers. Estimates from previous studies suggest that after four treatments, nearly a third of patients fail to achieve remission. As such, COMPASS is targeting the most treatment-refractory depression patients.

Recap: Phase 2b Key Findings

Note: COMPASS Pathways’ Phase 2b results remain unpublished, meaning they are yet to appear in a peer-reviewed journal.

As we discussed in our special issue last year, the two primary markers of success for COMPASS’ Phase 2b trial pertained to the treatment’s efficacy and safety. The study, which enrolled 233 participants, compared the effects of a single administration of one of three COMP360 psilocybin doses (25mg, 10mg, and 1mg) by assessing changes in MADRS scores from baseline to the primary 3 week endpoint. COMPASS measured treatment durability through a follow-up period that extended to 12 weeks post administration.

In regards to efficacy, the 25mg dose of COMP360 psilocybin proved to be the most efficacious, leading to a 6.6 point decrease in MADRS scores from baseline at the study’s primary endpoint.

The 25mg dose also showed greater durability of effects compared to the 10mg and 1mg doses. Nearly a quarter (24.1%) of patients treated with 25mg of COMP360 had a sustained response at week 12, compared to roughly 10% for both the 10mg and 1mg cohorts. As we noted last year, these findings are undoubtedly positive in light of the treatment-resistant nature of this trial’s target indication. However, it is important to recognize that the majority of patients in all arms of the trial failed to sustain a response at 12 weeks. These findings left many wondering if one or more additional doses of COMP360 psilocybin could have improved the treatment’s efficacy and durability.

While the treatment efficacy that COMP360 psilocybin therapy demonstrated through this Phase 2b trial was certainly encouraging, some concerns around the safety and tolerability of COMP360 tempered enthusiasm. Overall, 12 participants reported treatment-emergent serious adverse events (TESAEs) over the course of the trial. These events included suicidal ideation and behaviour, as well as self-injury.

Interestingly, only 1 of these TESAEs occurred in the 1mg treatment group, which was effectively a placebo dose. The remainder occured in “active” treatment arms, with five being reported amongst patients given 25mg of COMP360 and six amongst patients given 10mg of the drug. These data suggest a connection between an active dose of COMP360 and TESAEs.

Naturally, company execs attempted to quell these safety concerns, explaining that many of the TESAEs were reported among participants who did not respond to the COMP360 psilocybin therapy. As a result, many have since suggested that perhaps the hype and putative promise of psychedelic therapies could be to blame. Accordingly, it may be the case that unmet participant expectations could have exacerbated or created feelings of hopelessness and despair amongst treatment non-responders, the theory goes. Whether this adequately addresses the TESAEs seen in the Phase 2b trial is the subject of ongoing debate.

Some Key Questions & Considerations Arising from Phase 2b

As Chief Development Officer (CDO) Trevor Mill discussed, COMPASS came away from its Phase 2b study with a handful of essential considerations it needed to address moving forward, some of which echo questions we (and others) brought up late last year. The company summarised its key considerations into the four main questions listed below. These questions would eventually be used to inform the design of the company’s Phase 3 development program.

Q1: Can we replicate the treatment response seen in our Phase 2b?

Q2: How does the safety profile of COMP360 psilocybin compare to placebo?

Q3: Can a second dose increase treatment responders and/or improve response seen in Phase 2b?

Q4: Is there a meaningful treatment response from 2 x COMP360 10mg?

And, on expectancy…

During the presentation, Dr. Sidney Zisook provided some insights into his experience with the company’s Phase 2b trial, sharing:

“On the one hand, I had never been involved in a trial before where I heard so much really profound gratitude for participants in the trial. There was a group of the participants who just felt that… they had an extraordinarily meaningful experience, a deep experience, they felt more connected, they felt that they were on the road to an opportunity to have a different life and to view things differently. I’ve never before experienced anything quite like that.”

“On the other hand, we had a significant minority of people, fewer, that had more profound disappointment with the trial than I had experienced in other studies. And I might remind you that these are people who came to us with treatment-resistant depression, often quite severe, affecting a large portion of their lives, had failed all of the standard treatments already out there, looked to this study with great excitement and enthusiasm as a second chance, and there were some that just during the dosing day, slept through it, napped through it, didn’t have much of an experience at all, and were profoundly disappointed thereafter. And that was a novel experience as well.”

This quote from Zisook certainly speaks to prior suggestions that some of the TESAEs reported during COMPASS’ Phase 2b trial may be attributable to hightended and unmet expectations. Moving into Phase 3, it will be interesting to see how, or even if, the company plans to mitigate the impact of expectancy on treatment and safety outcomes.

***

The Phase 3 Program

Remember: Following the successful completion of Phase 2 clinical trials, sponsors may advance their program forward into Phase 3 of the development process. Through Phase 3 clinical trials, the safety and efficacy of a treatment candidate is evaluated in a larger pool of participants. As our primer on drug development explains, typically, at least two successful Phase 3 trials are required in order to provide regulators with sufficient evidence of efficacy. As such, these larger pivotal Phase 3 trials are often multi-centre, international efforts.

Program Structure

During the presentation, CDO Trevor Mill announced, to the surprise of many, that COMPASS’ Phase 3 program would consist of two concurrent pivotal trials. Both trials, COMP 005 and COMP 006, are expected to begin before the end of 2022 and will aim to enrol nearly 950 participants total. Each would be the largest trial of a psychedelic-assisted therapy by a wide margin.

The smaller COMP 005 trial is expected to occur across 62 sites in seven countries, and the larger COMP 006 trial is set to take place across 88 sites in eight countries. However, once the COMP005 trial is complete, COMPASS expects some sites will pivot to support the COMP 006 trial. The company states that 25% of its Phase 3 sites were prior participants in its Phase 2b study. COMPASS intends to cluster these “key performing sites” with new participating sites in order to “maximize learning from Phase 2b.” While the primary endpoints for COMP 005 and COMP 006 are at six weeks, both trials will also include a longer-term follow-up study.

Pivotal Study 1: COMP 005

COMP 005, the company’s smaller Phase 3 trial, will compare the effects of a single 25mg dose of COMP360 to a placebo. The trial will enrol an estimated 378 patients with a 2:1 randomization. This means that 252 participants will receive the 25mg dose of COMP360, and the remaining 126 will receive a placebo. Patients in both arms will receive psychological support. Efficacy will be measured at the trial’s primary six-week endpoint and will again be assessed based on changes in MADRS total scores from baseline.

Results from the COMP 005 trial should help answer the first and second of those “key questions” mentioned above that the company shared. Specifically, COMPASS is looking to replicate, or reconfirm the treatment response to a single 25mg dose of COMP360 psilocybin that was seen in its Phase 2b trial. However, in contrast to its Phase 2b trial, for COMP 005, the company appears to be planning on using a ‘true’ placebo control that is inert as opposed to a ‘sub-perceptual’ 1mg dose of its psilocybin.

Pivotal Study 2: COMP 006

COMP 006, the company’s larger pivotal trial, will once again compare 25mg, 10mg, and 1mg doses of COMP360 psilocybin, as in the Phase 2b trial. However, for this Phase 3 trial, the company has decided to introduce a second dose of COMP360 at week three. Like COMP 005, this trial will also measure efficacy based on changes in MADRS total scores from baseline at the six week primary endpoint.

An estimated 568 patients are projected to be enrolled for COMP006 with a 2:1:1 randomization. As a result, 284 participants should receive two 25mg doses of COMP360, 142 should receive two 10mg doses, and another 142 should receive two 1mg doses, all at three week intervals.

Results from the COMP 006 trial will also help address the third and fourth “key questions” that the company has identified. The repeat dose design of this Phase 3 trial will help the company determine if an additional treatment can improve patient outcomes beyond what was seen in its previous study. Presumably, any effect on treatment durability resulting from an additional dose will be an integral focus of the company’s longer term follow-up study. As we discussed in the previous Phase 2b recap, longer term treatment outcomes in the ‘active’ 10mg arm appeared to be, in some ways, comparable to the 1mg ‘effective’ placebo arm. Consequently, the company wants to understand if any “meaningful treatment response” to the 10mg dose can be achieved by adding a second treatment.

Study Timelines

While COMPASS has stated that both COMP 005 and COMP 006 will run concurrently, topline results are not expected to arrive simultaneously. The company anticipates that topline data from COMP 005 will be available near the end of 2024. For the larger COMP 006 trial, topline results are projected to be available by the middle of 2025. These timeline differences may result from the larger patient pool and the greater number of trial arms in the COMP 006 trial. Nonetheless, barring any delays, the earliest that one might expect initial results to be available appears to be around two years from now.

Thoughts & Concluding Remarks

The initiation of this Phase 3 program will represent a major milestone not only for COMPASS, but for psychedelic research and development more broadly. Through these two Phase 3 trials, COMPASS will hope to find answers to its “key questions”. However, these fundamental considerations aren’t the only things that might emerge from this development program.

As the company shared during its virtual event, COMPASS plans to leverage supportive technologies over the course of the Phase 3 program. Remember, COMPASS has stated that the use of digital tools is one of three core elements of its COMP360 Psilocybin Therapy. These tools include COMPASS’s online Therapist COMPanion platform built to support treatment providers, the myPathfinder mobile patient support app, and Chanterelle, the company’s ongoing effort to leverage artificial intelligence and natural language processing (NLP) in an attempt to identify more objective biomarkers of mental health to deliver more personalised care to patients.

Last year, following the release of topline Phase 2b data, former CEO George Goldsmith described how the company had begun analysing both qualitative and quantitative participant data from its Phase 2b trial in an attempt to identify correlation with treatment outcomes.

Since then, a significant element of the company’s efforts appear to have been focused on leveraging NLP in order to identify potential biomarkers that can be used to predict patient outcomes (see a preprint by Dougherty et al., 2022). As you can see below, the model seems to be able to identify responders with significant accuracy. It should be noted, however, that this is achieved the day after COMP360 psilocybin administration: i.e., after the bulk of the costs of the treatment have been burned through. Of course, if multiple psilocybin administration sessions are called for (as the COMP006 trial will explore), this predictive capability might be more impactful on the cost and efficacy of the treatment protocol.

COMPASS plans to further validate these models through its Phase 3 program. Additionally, the company will continue to leverage its other punny platforms like the myPathfinder app and Therapist COMPanion to support patients and providers.

Remember: psychedelic-assisted therapy is expensive, meaning it will be a hard sell to payers like insurance companies and state healthcare systems. Companies like COMPASS are hoping that employing tech (from NLP models through to patient-side prep and integration tools) will not only increase the safety and efficacy of their protocol, but will also cut costs in a multitude of ways (from identifying non-responders right through to reducing the costs associated with prep and integration therapy sessions). This technology might also (eventually) be used on a more long-term basis to identify patients sliding into relapse and suggest appropriate interventions.

Indeed, COMPASS has stated that it envisions COMP360 Psilocybin Therapy for TRD being an “episodic treatment” for some patients, with “up to 2-3 administrations per year”. Other psychedelic drug developers also employ more than one dosing session, such as MAPS’ Phase 3 MDMA-assisted therapy for PTSD protocol which employs three MDMA sessions.

COMPASS’ ongoing efforts also extend well beyond its flagship forthcoming Phase 3 program. Within the last year, the company launched two Phase 2 clinical trials to evaluate its COMP360 Psilocybin Therapy as a treatment for Anorexia Nervosa and Post-Traumatic Stress Disorder (PTSD). Both of these company-sponsored trials are, for now, set to wrap up in the second half of 2023. In addition, COMPASS has its sights set on broadening its drug development pipeline with new chemical entities, prodrugs, and non-psychedelic compounds.

COMPASS also continues to work with academic collaborators on a number of “signal generating” studies using COMP360 that may be used to inform future development efforts. As such, we shouldn’t expect to have to wait until the end of 2024 to hear further data readouts from COMPASS’ drug development efforts.

Other Company News

Since we’ve been gone for a couple of weeks, here’s a round-up of other company news…

- atai dosed the first subject in a Phase 1 trial of buccal and IV DMT (VLS-01) | atai is developing this synthetic form of DMT in combination with a digital therapeutic that aims to provide preparatory support. The single-ascending dose study expects to read-out results in H1 2023.

- atai also announced initial results from a Phase 1 trial of KUR-101 (Mitragynine) | Mitragynine is the most abundant active alkaloid in the leaves of kratom, and is being explored as a treatment for opioid use disorder (OUD). Topline results, which include a comparison of KUR-101 to oxycodone or placebo, are expected by the end of 2022.

- Silo Pharma closes $5.75m public offering | Note: despite prominently proclaiming a “Nasdaq Listing” in the press release’s title, the company is listed on the Nasdaq Capital Market, the lowest of Nasdaq’s three tiers. Generally, this tier is not considered to confer the title of a ‘Nasdaq-listed’ company.

- MindMed’s collaborators at Matthias Liechti’s lab initiate Phase 1 comparative trial of R-, S- and racemic MDMA | As we covered last October, MindMed is hoping that R(-)-MDMA might prove to be more effective in the treatment of certain indications than S- or racemic MDMA (the week after that reporting, we spoke to Rick Doblin about the potential benefits of individual isomers of MDMA – he had some interesting comments and anecdotes). It’s taken a year to get the Phase 1 trial underway.

- Mindset Pharma selected lead candidates from “Family 2” of its next gen psychedelic portfolio | MSP-2020 will be the company’s lead candidate from this family, with MSP-2003 selected as a back-up. Reminder: this family is being explored in collaboration with Otsuka’s McQuade Center for Strategic Research and Development (the collaboration was announced in January of this year).

- Numinus announced that it has developed a mushroom tea for use in psychedelic research | The company hopes its psilocybin-containing tea bag will be used in clinical research, starting with a Phase 1 trial that might see practitioners receiving a 25mg dose as part of an experiential training element.

- Ronan Levy leaves Reunion Neuroscience | Now that Field Trip has split into two separate companies, Levy has resigned as Director of the drug development side of things. The company’s lead candidate, FT-104, is now dubbed RE-104 to reflect the name change. We covered FT-104 back in December 2021. Reunion’s CSO, Nathan Bryson, recently drew ire from a number of folks in the psychedelics space after he made a submission to the DEA regarding the administration’s proposed scheduling of 5 tryptamines. Rather than making the case for all five tryptamines to be saved from scheduling, or simply arguing for 4-HO-DiPT (of which FT-104 is a prodrug) be spared, Bryson recommended that the four other tryptamines be added to Schedule 1 (we broke this news in our Special Report on the same topic).

- Small Pharma reported its fiscal Q2 2023 highlights | $27.1m cash on hand (as of Aug 31).

- London-based psychedelic CRO Clerkenwell Health closed a £2.1m round, and received coverage in outlets like the Evening Standard.

Explore more company press releases here.

Featured Psychedelic Jobs

- Psylo is hiring a VP of Drug Development.

- PsyMed Ventures is looking for a full-time Ops Associate.

Johns Hopkins Center for Psychedelic and Consciousness Research is hiring a Research Program Coordinator.

Browse more roles and get more job posts to your inbox by signing up for alerts here.

Weekend Reading

Alberta Will Be First Canadian Province to Regulate Psychedelic Therapy

Canada’s fourth largest province, which has a population of 4.5 million, will become the first to regulate psychedelics when new rules come into effect in January 2023.

The regulations will require service providers looking to deliver psychedelics in the treatment of psychiatric disorders (e.g., clinics) to be licensed. It covers, initially, 5-MeO-DMT, DMT, ketamine, LSD, MDMA, mescaline, psilocin and psilocybin.

The regulations will require qualified professionals to apply for licences before treating patients; stipulate that a psychiatrist must oversee any treatment; and will aim to ensure that psychedelic therapy is only administered in medical facilities (with an exemption for palliative patients). The new regulations were announced alongside other drug policy changes that allow for the prescription of certain opioids to those suffering from Opioid Use Disorder.

However the implications of the new regulations, and how they’re enforced, are not yet clear.

Some are optimistic. In a press release, Vancouver-based psychedelic manufacturer Optimi Health heralded the move by exclaiming: “Alberta Puts Patients First”. This is perhaps unsurprising, as a manufacturer like Optimi might do well in a regulated environment, as the company is at pains to explain in its heavily promotional PR.

However, the regulations might also be used as a way to bear down on unlicensed providers. Keep in mind that Alberta is widely considered as one of (if not the) most conservative provinces in the country: the ‘Texas of Canada’.

It’s also worth noting that shortly after the changes were announced, Alberta’s premiership changed hands, with Danielle Smith—leader of the United Conservative Party—becoming its new premier.

And, finally, it’s worth remembering that the regulation of drugs and controlled substances falls under the remit of the Government of Canada, not provincial governments. Marc Goldgrub, a lawyer at Green Economy Law, confirmed this point, explaining that doctors and therapists in Alberta (and elsewhere) can only access and/or provide psychedelic-assisted therapy if the federal government permits it. This is happening at a relatively small scale through the Section 56 pathway, as well as the Special Access Program.

It is clear, then, that changes to federal law are a prerequisite for this change in rules to have any significant effect. However, Goldgrub explained that healthcare is largely regulated by the provinces, meaning Alberta’s amended rules might represent a proactive move to prepare for medical psychedelics’ potential legalisation at the federal level.

In short: while these changes demonstrate awareness of psychedelic therapy, and some level of expectation that PAT is coming down the pike, it’s unlikely that they represent any meaningful increase in the accessibility of psychedelic therapy for now.

Australian Capital Territory Decriminalises Small Amounts of Psilocybin, MDMA, LSD, Others

The Australian Capital Territory, which has a population of just under 500,000 and houses the country’s capital city (Canberra), has become the first territory Down Under to decriminalise small quantities of illicit drugs.

Those found with small amounts of 9 scheduled drugs will no longer be criminally prosecuted. Rather, they will be cautioned, fined, or required to attend a drug diversion program.

The health minister of the region, Rachel Stephen-Smith, explained that harm-reduction was the way forward, not the punishment of drug users.

Of the 9 drugs, three are ‘psychedelic’ in nature:

- LSD – 0.001 grams (1000 μg)

- MDMA – 1.5 grams

- Psilocybin – 1.5 grams

The amendments take effect next October.

NIDA Grant Opportunity: Psychedelics for Substance Use Disorders

The National Institute on Drug Abuse (NIDA) is accepting grant applications from small businesses (or their collaborators) looking to develop ‘psychoplastogenic compounds’ as a therapy for a substance use disorder.

For the purposes of this grant, ‘psychoplastogenic compounds’ include both psychedelic and non-psychedelic 5-HT2A agonists as well as ketamine and MDMA, among others. It’s open to United States-based small business concerns, and would be a non-dilutive grant. Applications are due November 18, 2022.

You can find more information about the grant here, or reply to this email to be connected with NIDA’s scientific/research contact for this opportunity.

Two Oregon Counties See Campaigns to Oppose Psilocybin Opt-Out Initiatives

As we move closer to the November elections in the U.S., Psilocybin Services Opt-Out campaigning activity is heating up in Oregon.

Interestingly, there are now two organised campaigns opposing opt-out measures in Deschutes and Jackson County. Both campaigns seek to leverage the growing evidence base surrounding the potential benefits of psychedelic therapies, and the latter campaign focuses heavily on how this might help veterans.

Talking to Psychedelic Alpha, Melissa Sanchez (from Deschutes County’s VOTE NO ON 9-152 campaign) said:

Here in Deschutes our community has felt the need to organize in opposition of Measure 9-152 to protect access to psilocybin services. We find ourselves in a mental health crisis. Our country desperately needs more solutions and less barriers to access natural alternative therapies. Oregon is leading the country in adopting this breakthrough therapy, we should not be limiting access with proposed opt outs. Instead, communities and local governments should be working in alliance for our most vulnerable populations that suffer daily with crippling mental health disorders.

To reflect these efforts we have added a new category to our Oregon Psilocybin Services Act Local Jurisdiction Tracker.

American Psychedelic Practitioners Association (APPA) Launches

APPA officially launched during Horizons in New York City, and is now accepting members via their website (free for 6 months).

The association hopes to establish standards of care and training for the field, as well as advocating, educating and building community.

Miscellany

- Right to Try Case Update: Kathryn Tucker et al.’s Right to Try petition, which requested that the DEA reclassify psilocybin as a Schedule II drug, has received a final decision from the Administration stating that psilocybin will remain in Schedule I. Proponents of the petition appear buoyed by the “clean crisp denial” from DEA (in Kathryn Tucker’s words), though, as it may allow for a more propitious challenge or review.

- New Report from BrainFutures: “Elements of Psychedelic-Assisted Therapy: The good folks over at BF have published their latest in a series of reports on psychedelic therapies. This one focuses on the psychotherapy element.

- Matt Zorn and Shane Pennington’s On Drugs newsletter is always recommended reading. In the most recent two issues, Pennington has reviewed the significance of Biden’s cannabis scheduling directive. It may very well have implications beyond cannabis.

- According to the Federal Reserve, the average American household had a median balance of just over $5k in their bank accounts (checking and savings) just prior to the pandemic. Oregon’s psilocybin services are likely going to be reserved for the wealthier Oregonians, then – just like the ketamine spas that have popped up across the country, and the international psilocybin retreat market.

- Hour-long documentary on PBS: Can Psychedelics Cure? – Some have pointed out that the use of the word ‘cure’ in the title of this show is problematic, and is getting ahead of the evidence. We thought this hour-long doc did a good job of providing an overview of psychedelic research, including the foregrounding of a number of patient experiences. The mechanism of action content was a little sparse, but it would be tricky to elucidate much more without monopolising the 53 minutes available. Perhaps it’s best if we just wait until the evidence arrives? Anyway, well worth a watch.

- Why is the American right suddenly so interested in psychedelic drugs? Ross Ellenhorn and Dimitri Mugianis seek to address this question in a Guardian Opinion piece.

Weekly Bulletins

Join our newsletter to have our Weekly Bulletin delivered to your inbox every Friday evening. We summarise the week’s most important developments and share our Weekend Reading suggestions.

Live Updates

Join us on Twitter for the latest news and analysis.

Other Channels

You can also find us on LinkedIn, Instragram, and Facebook.